If your small business receives income via third-party settlement processors like PayPal, Venmo, and CashApp, you may be in for a surprise.

The American Rescue Plan Act (ARPA) passed by Congress in 2021, provided pandemic relief to many small businesses. It also included a bill that significantly changed reporting requirements for third-party settlement organizations like PayPal, Venmo, and CashApp. The new ruling also affects platforms like Etsy, Uber, E-Bay, Upwork, etc., that provide settlement services on behalf of self-employed workers.

What’s the big change?

Starting in 2023, third-party settlement organizations (TPSOs) must report any income you receive “for goods and services in excess of $600” to the IRS. Prior to the bill, these processing platforms only reported income when it was more than $20,000 and included over 200 transactions in a year. That’s a pretty big change! It also means that many more people will receive a 1099-K for the first time.

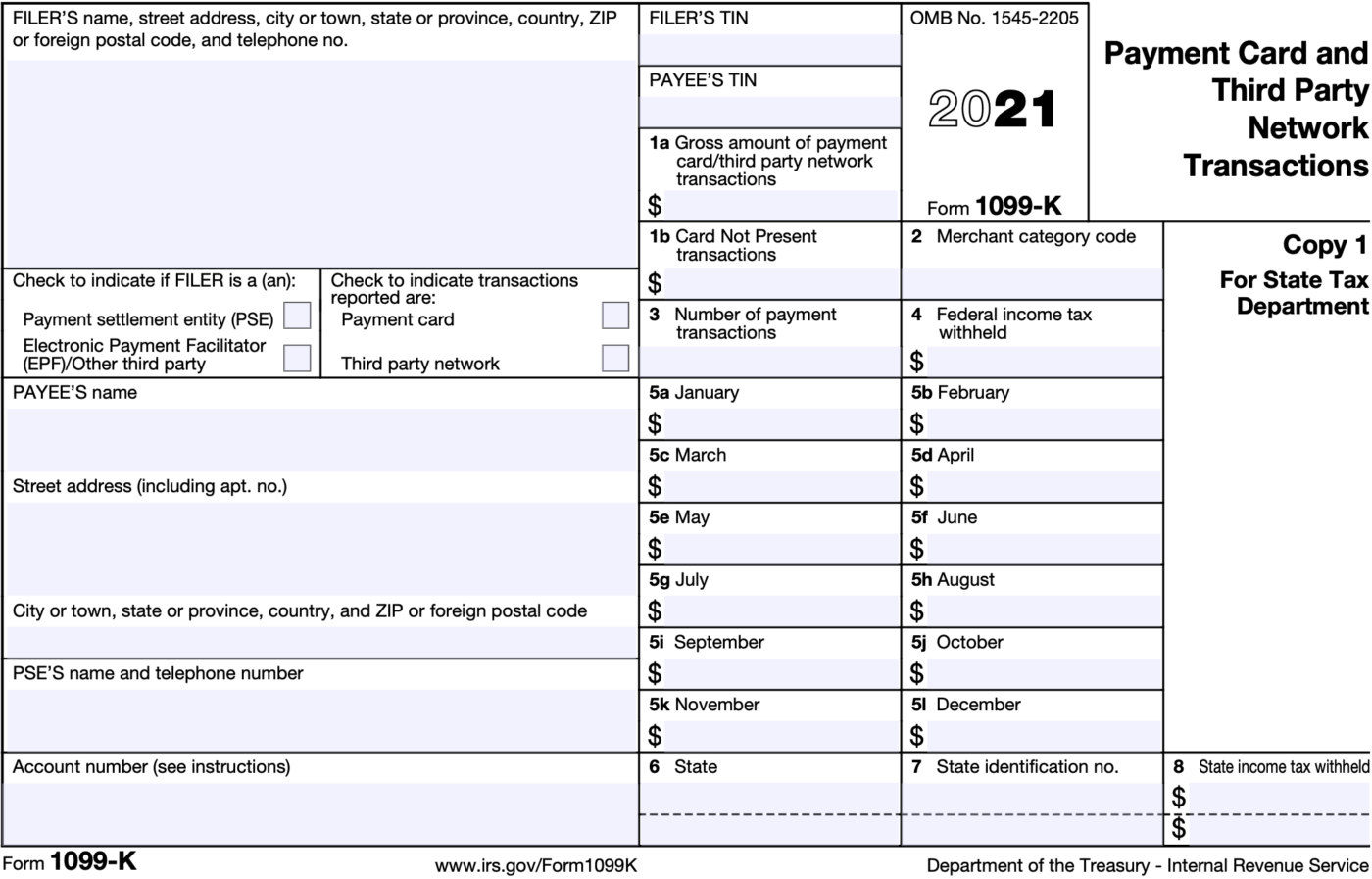

What’s a 1099-K?

IRS 1099 forms are “information” tax forms used to report the many different types of income people receive, to the IRS. The idea is that it increases voluntary tax compliance. When you receive a 1099 from someone, it means the IRS has a copy too. They will match it to your tax return to make sure you correctly reported your income.

The 1099-K is the form used by credit card payment processors and third-party settlement organizations to report the income they processed on your behalf. Credit card companies report all transactions made to your business. However, TPSOs only reported income if it was $20,000 or more and involved at least 200 transactions. Starting in 2023, they must report all income received for “goods and services” in excess of $600. There is no minimum number of transactions.

How does PayPal or Venmo know if I sold a good or service?

Using Venmo as an example, transactions to all Venmo business profiles are automatically tagged as “good or service” transactions.

When sending money to an individual account, buyers have the option to tag the transaction as a good or service. This may also have the added benefit of providing buyer/seller protection on the purchase if there is a dispute.

Any transaction tagged as a good or service, whether it goes through a business or personal account, will be reported once the account meets the $600 threshold.

So what does this mean for my business?

Report all your income

Your business income is most likely a combination of cash, checks, and credit or debit card payments. Some of this you receive directly from a customer and some of it goes through credit card and third party settlement platforms. You should report all business income you receive, no matter where it comes from or what kind of payment it is.

This is not only good practice — it’s also the law. Not reporting income is problematic if you find yourself the target of an audit. It will also make your business look less profitable and therefore less valuable if you ever intend to sell it.

Be sure to track refunds, discounts, and exchanges

The 1099-K will report gross income or sales, but will not show any deductions for refunds, discounts, exchanges or other transactions that reduce the gross number. Be sure to track these adjustments and report them as a separate line item on your tax return.

Review 1099s carefully

If your business paid a contractor more than $600 in a year, you’re required to report the payment on a 1099-NEC form. However, according to IRS rules, if you make the payment via a third-party settlement organization you do not need to report it as long as it goes to a business account, or is tagged as a good or service to a personal account. In this situation, the vendor or contractor will be getting a 1099-K from the third-party settlement organization.

If you’re self-employed, it’s possible your business income might be reported to the IRS twice for the same transaction. Once by the payee and again by the TPSO. Be sure to carefully track your sales records and review any 1099s for possible duplications. Be sure to talk to your accountant about how to get this information corrected if it does happen.

What if I’m just paying a friend or family member?

If you’re making a payment to a friend or family member using a personal account for something like a reimbursement, these transactions will not be included in reportable income. Just be sure not to tag it as a good or service.

If you use Venmo and other similar apps for your business, be sure to set up a separate business account from your personal transactions so these transactions are not added to your reportable income.

Each platform will have different ways of tracking goods and services. Be sure you check for this information on their website.

Understanding Your 1099K (IRS)

Tax Reporting Requirements – Venmo and PayPal

Entrepreneur Magazine: New IRS Rule targets very small businesses